Winter boost for PADD 1 diesel imports?

Winter boost for PADD 1 diesel imports from reverse arb flows?

As the US northeast (PADD 1) heads into the winter season, one factor on the minds of diesel market participants is whether the the change of seasons will drive a change in flows.

During periods of colder weather, an upswing in diesel/heating oil demand lifts PADD 1 import activity and occasionally even opens the possibility of ‘reverse-arb’ cargoes from Europe and Russia. Vortexa data shows such activity is already getting underway.

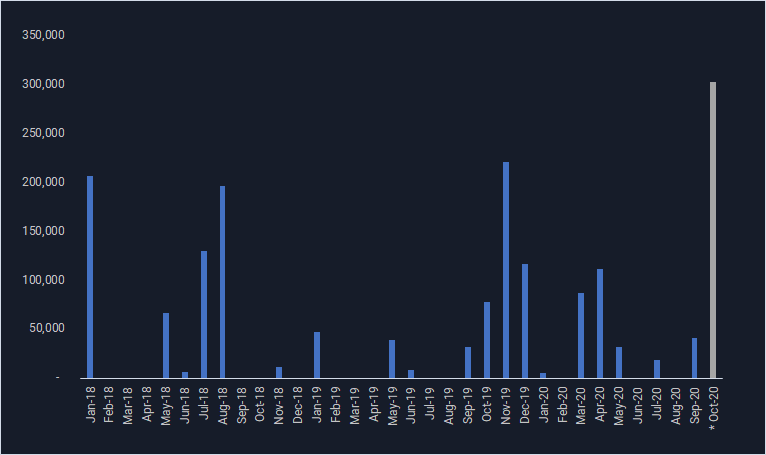

Transatlantic diesel/gasoil exports to PADD 1 (mt) – * October figures preliminary

Reverse arb flows emerge

-

Diesel flows from Russia and Europe to the US are rare, as Europe typically imports diesel from north America, rather than exporting to it. And given Europe’s proximity to Russian Baltic ports, diesel flows from Russia are almost always captured by European buyers instead of heading transatlantic.

-

But early into Q4, Vortexa data shows traders have already started exporting European and Russian diesel cargoes towards PADD 1, underpinned by the weak European diesel market and as evidenced by the widening spread for northwest Europe vs New York diesel/heating oil prices.

-

As of 6 October, at least 120,000 mt of diesel has already loaded or will shortly load, from Europe in October, across three MR tankers expected to head to New York.

-

This total could grow by a further 180,000 mt that has been booked to load across two LR2 tankers from the UK’s east coast during 6-9 October for PADD 1 discharge, provisional shipping fixtures show. Namely, LR2 Megalonissos and Polar Ace could both load via STS off Southwold, UK in the coming days. Both tankers’ shipping fixtures also show discharge options to other transatlantic destinations such as the Caribbean.

-

Should the above LR2 shipments materialise, the combined total of around 300,000 mt would surpass the multiyear high for reverse arb flows to PADD 1 diesel, seen in November 2019 (see chart above).

East coast refining woes

-

A key support for the reverse arb flows this year is suppressed refining activity along the Atlantic east coast.

-

In the last 12 months, PADD 1 (weekly) refinery utilisation has surpassed 70% for only 2 weeks, EIA data show. In contrast, PADD 3 refinery utilisation has only dropped below 70% for one week over the same period.

-

PADD 1 refiners have struggled to boost run rates despite the closure of the Philadelphia Energy Solutions (PES) refinery last year, and to reach pre-covid 19 run rates despite the shutdown in March of the Come-by-Chance refinery on Canada’s east coast – a major supplier of refined products, including diesel, to PADD 1. Weak total refinery margins in the region are disincentivising refiners to boost runs themselves, thereby triggering reverse arb flows.

-

If the Come-by-Chance refinery does close permanently, as indicated in some media reports, PADD 1 dependence on alternate sources for diesel/heating will likely to continue going forwards.