Identifying trading opportunities through oil tanker shipping routes

In this article we analyse 4 anomalies in shipping routes that can signal of trading opportunities: tanker speed, areas of congestion, competitor movements as well as vessel routes and destination.

In what can be a very murky industry, obtaining precise and accurate data that highlights movements within the global oil and gas market was once exceptionally challenging.

Through extensive industry expertise, innovation and a technological edge, Vortexa has broken down the boundaries of limited intelligence. We provide pinpoint-accurate data across oil tanker shipping routes, their cargo and more, to paint a clear picture of the global energy market.

By providing detailed access to real-time global cargo data, our advanced AI platform provides deep insight into the global waterborne oil and gas trade. This helps the leading trading and shipping companies that partner with Vortexa to identify opportunities before their competitors.

There are four strategies for reading oil and gas data when looking to find new trading ideas through oil shipping routes. The following is covered within this article to help you identify opportunities in the energy market first:

Anomalies in shipping routes

- Tanker speed

- Areas of congestion

- Competitor movements

- Vessel routes and destination.

By studying oil shipping routes in our advanced analytics platform, you can accurately monitor historical, real-time and forward looking data from around the world to identify new trading opportunities. See changes to a vessel’s location and direction by the minute so you can be the first to respond to market changes.

Vortexa simplifies the process when looking to spot oil trading opportunities. Using the Vortexa platform you can undertake detailed voyage analysis and track the routing decisions made by cargo buyers/sellers in real time. Thus showing you the urgency required in delivering cargoes.

For example, analysing how many ships are travelling via The Cape of Good Hope when compared to the Suez Canal can give you valuable insight into the economics behind a deal, telling you whether a journey is more profitable when taking the long way round.

If a vessel is taking the longer route, this would imply that traders are trying to deliver the cargo on board later, and are looking to achieve a later pricing window. This would suggest that the market is backwardated, providing key strategic direction that gives substance for your next energy market move.

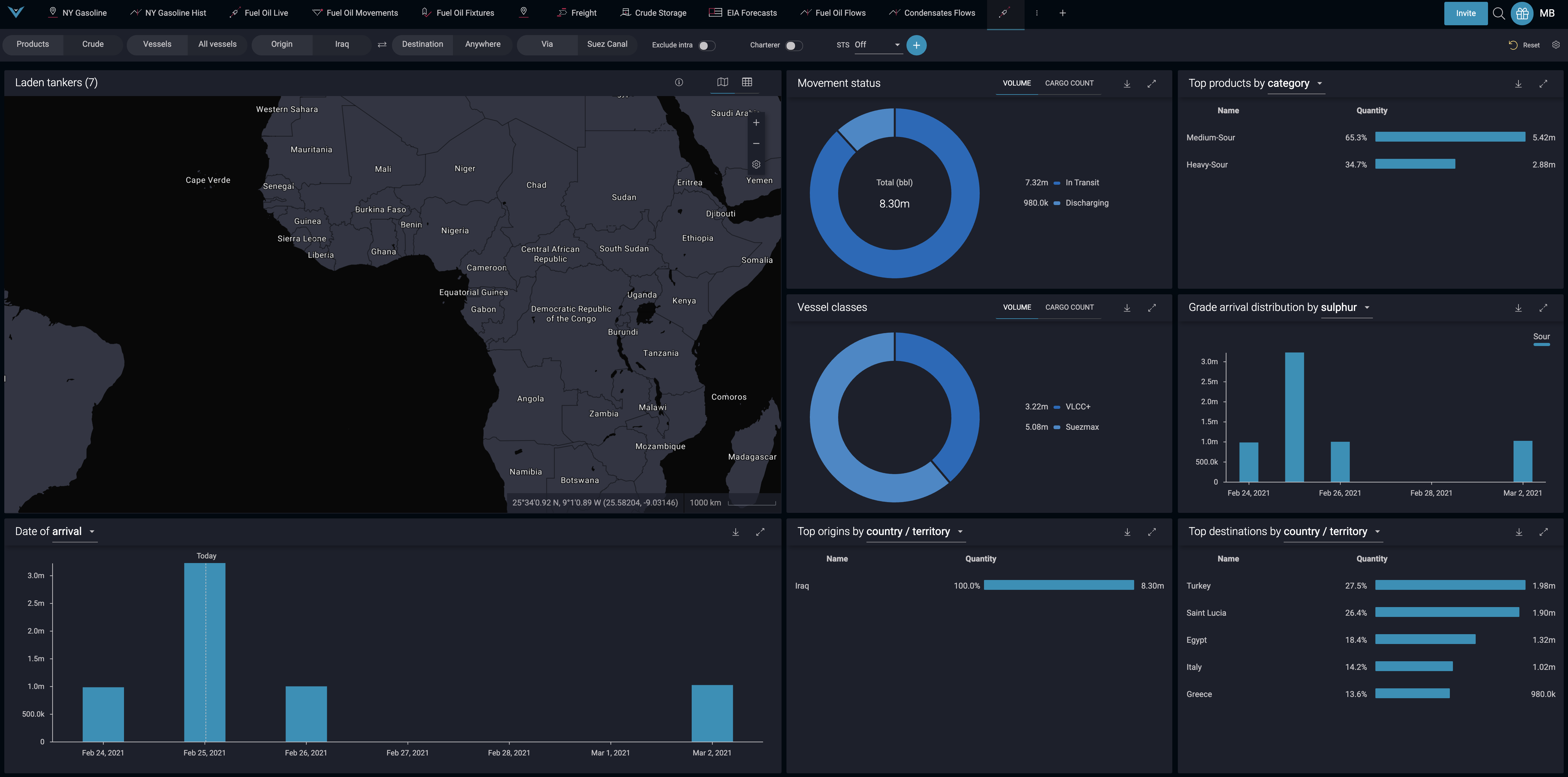

Latest Iraqi crude exports travelling via Suez Canal via Vortexa Analytics

Tanker speed as a market signal

Speed can also be a real-time key market signal that helps when looking to identify opportunities in energy markets. With Vortexa, you have all this information and more at your fingertips. Let’s break this down some more.

Cargo vessels speeding up may indicate a desire from ship owners to capture current market rates. This would indicate that the freight market is strong and the shipping company is looking to capitalise on this.

In contrast, ships are not allowed to slow down whilst carrying cargo unless this has been agreed with by the cargo owner. If they do, this could be an indication of ullage issues as the tanks are too full at the destination terminal.

A potential correlation for this could be a lack of demand for the product at the destination, which ultimately leads to lower prices across the products on board.

Identify areas of congestion

Identifying areas of congestion across global waterborne oil tanker routes enables better strategic direction for decision-making. Vortexa’s voyage calculator also allows shipping companies to plan routes in advance to avoid any congested areas and the potential waiting costs that arise because of this.

For example, as much of Europe’s crude oil supply from Russia is delivered through the Turkish straits, if these narrow waterways are congested many Crude imports to Europe will arrive late. If this Crude arrives too late, then refiners may incur disruptions that affect their product sales. This congestion creates an opportunity in the market for another supplier to fill the need of European refiners.

Competitor analysis and tracking supply deals

By tracking regular oil tanker shipping routes, it becomes possible to determine what competitors are doing within the market. You can discover comprehensive market insights that will help you capitalise on the immediate access to all cargo movements, the products on board, their volumes, speed and much more. Find all the granular freight information that will help you plot your next move, from charterer, to fleet owner and more.

A thorough understanding of competitor movements in the market can provide key direction to your next move. This also includes long term supply deals, helping you bridge the gap between movements across the world’s waterways.

Request a demo today

Vortexa has revolutionised access to oil tanker shipping routes across the globe, making it easy to analyse accurate, real-time data that drills deep into the direction of global energy markets.

By solving problems that held back the level of transparency across the industry, we are paving the way towards a new energy market, empowering both traders and shipping companies to improve their internal strategies to identify oil opportunities and better predict supply and demand.

Our platform provides critical trading and shipping market intelligence that unearths comprehensive market insights. Request a demo and try it for yourself.

{{cta(‘bed45aa2-0068-4057-933e-3fac48417da3′,’justifycenter’)}}