Two truths – why OPEC+ is hesitant

Vortexa looks deeply into oil shipments with strong visibility especially into the more opaque corners of the market to evaluate at the status quo of the oil demand recovery and evaluate if there is good reason for OPEC+ to be hesitant in unleashing oil supply onto the market.

In the current market, Oil futures appear to have only one way to go: up. From a bigger picture perspective, oil demand is set to recover strongly post Covid-19. And on the supply side, only constraint is seen. On the one hand, a lack of investment appears apparent on a mix of unfavourable conditions, with climate change and respective ESG policies playing a bigger role than ever. Even for the US shale industry supposedly “everything is different this time”. On the other hand, barrels are deliberately withheld by OPEC+ tightly managing the market, with a strong focus to bring inventories down.

Against this backdrop and in a generally inflationary environment, market consultants and banks appear to be competing on how to formulate the tightest description of the market, rebuffing light-handedly a potential Iran comeback, sizable OPEC spare capacity and doubts on the actual extent and/or limitations of the demand-side recovery.

Being deeply entangled in oil shipments with strong visibility also in the more opaque corners of the market (there are many in terms of geography and products), we take a look at the status quo of the recovery, coming to the conclusion that there is good reason for OPEC+ to be hesitant in unleashing oil supply onto the market.

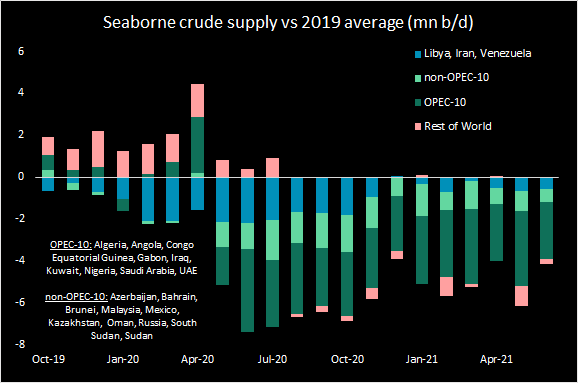

Seaborne crude flows rising in June

After a sharp drop in May, preliminary data for June actually suggests a quite sizable increase in seaborne crude shipments. At 46mn b/d, the tally is up 2mn b/d month-on-month, but only by a meagre 0.5mn b/d vs. the previous five months. And the figure is still more than 5mn b/d or 10% lower than the average from Q4 2019. Given that the June loadings are supposed to meet seasonal peak demand in July and August, this is a far cry from a wide-reaching market recovery.

Seaborne crude loadings by country group vs 2019 average (mn b/d)

See data in platform: (Total, OPEC-10, non-OPEC-10, Libya-Iran-Venezuela (incl. barrels without origin))

Putting on the bulls’ glasses, the chart above does however highlight a couple of key trends:

1) The supply of the three OPEC countries without production targets (Iran, Libya, Venezuela) is up by 1.6mn b/d year-on-year, leaving less room for comeback barrels to spoil the party going forward.

2) The contribution of non-OPEC countries in the OPEC+ conglomerate has already shrunk by more than half.

3) The rest of the world is now largely showing consistent declines vs the 2019 average, alluding to issues with natural decline and a lack of upstream investment feeding through.

In other words, it is now largely up to core OPEC-10 countries to constrain the supply deliberately, meaning that the relevant spare capacity is in reality much lower than EIA’s number of 7mn b/d for the month of June.

Meanwhile, the notion that OPEC-10 has so far not increased production levels that much is underpinned by a look at combined crude and product exports. While the communicated path would allow for about 1.2mn b/d more output in June relative to April, total oil exports from OPEC-10 of 24.5mn b/d are only up by about 0.6mn b/d.

Cross-barrel trends point to global oil demand weakness

Continuing our effort to get an understanding of the current demand dynamics, we look at arrivals of crude, clean and dirty products into a subset of the globe – excluding China (highly volatile due to SPR and other policies) as well as key oil producers, namely, OPEC, Azerbaijan, Kazakhstan, Russia as well the Canada and the US. The idea is to get a feeling for underlying demand, irrespective of whether it is for refining (crude, secondary feedstocks) or finished products.

Seaborne oil arrivals in selection of countries (mn b/d)

The chart shows that in this market subset, which accounts for more than 60% of the global total, June may come in lower than any month since November 2020. This reinforces what we saw in May, which marked the end of a previous trend of slight improvement during the previous months. The most recent wave of the pandemic in Asia and other regions is apparently taking its toll. Overall, the subset markets (see chart) still import some 6mn b/d less oil compared to pre-Covid levels.

Apart from current limitations due to Covid-19, here are some candidates why the anticipated recovery may fail to reach or surpass historical levels:

1) Permanent loss of jet fuel demand

2) Steadily escalating substitution of oil by cheap electricity

3) Income effects in the current inflationary environment – a sizable chunk of the global population being worse-off economically in a post-Covid/post-social distancing world

Core OPEC players may struggle placing barrels

Drilling deeper into this data, an interesting trend emerges when focussing only on Middle Eastern oil exports to the above global subset of countries. Here we can see a steady decline for years, with June potentially coming in as lowest month total since at least January 2019.

Seaborne oil arrivals in selection of countries, imported from the Middle East (mn b/d)

Putting aside minor flows to the US, this chart just underpins the paramount importance of China for Middle Eastern exporters/OPEC. But after record purchases last year amid low prices, the Chinese government looks to be sending clear signals to reign in refining and storage activity for now via additional feedstock taxes, lower crude import and likely product export duties.

Taking all this into account, it is not surprising that core OPEC players are hesitant to increase supply much. The reality on the ground is simply that core OPEC-10 players are struggling to place additional barrels at current prices. Nor do dirty freight rates in the doldrums and range-bound physical crude differentials suggest that a change in dynamics is imminent.

The price rally is founded on OPEC’s success in constraining supply as well as forward-looking expectations on a demand picture that is far better than the recent past. Of course US dynamics look different and this is coincidently where many market commentators and financial speculators are located. But in spite of its importance the US represents only a minor part of the world, while the selection in the above two charts reflects a barely visible and noticed majority of the market.

More from Vortexa Analysis

- Jun 24, 2021 Surging diesel flows – a push or a pull

- Jun 23, 2021 $100 barrel of crude boon or bust for tanker markets

- Jun 18, 2021 Crude markets diverging in Atlantic Basin

- Jun 16, 2021 Question marks for freight rates in a largely supportive global LNG picture

- Jun 15, 2021 China’s independent refiners maneuver new diluted bitumen tax

- Jun 10, 2021 Transatlantic gasoline flows are here to stay

- Jun 7, 2021 Role reversal? West of Suez in the driving seat

- Jun 4, 2021 North American LPG shipments to Asia face pressure

- June 2, 2021 China’s new consumption tax turns tide of gasoline and diesel exports

- Jun 2, 2021 Suezmax tankers infiltrate Europe-bound transatlantic crude flows