$100 barrel of crude: boon or bust for tanker markets?

Oil prices are on the rise and a $100 barrel of crude doesn’t seem as far fetched as it did a few months ago. The implications of crude reaching this strong, symbolic price are wide-ranging, especially when it comes to freight markets.

Will OPEC+ step in and will this fuel a tanker market rally?

Oil prices are on the rise and a $100 barrel of crude doesn’t seem as far fetched as it did a few months ago. The implications of crude reaching this strong, symbolic price are wide-ranging, especially when it comes to freight markets. Will OPEC+ step in to cull prices from going sky high, by increasing output and thus fuelling a tanker market rally? Or will they let the price run potentially hurting oil demand, leading to weaker prospects of employment for crude tankers specifically? Let’s take a look.

Historically, prices tend to be inversely correlated

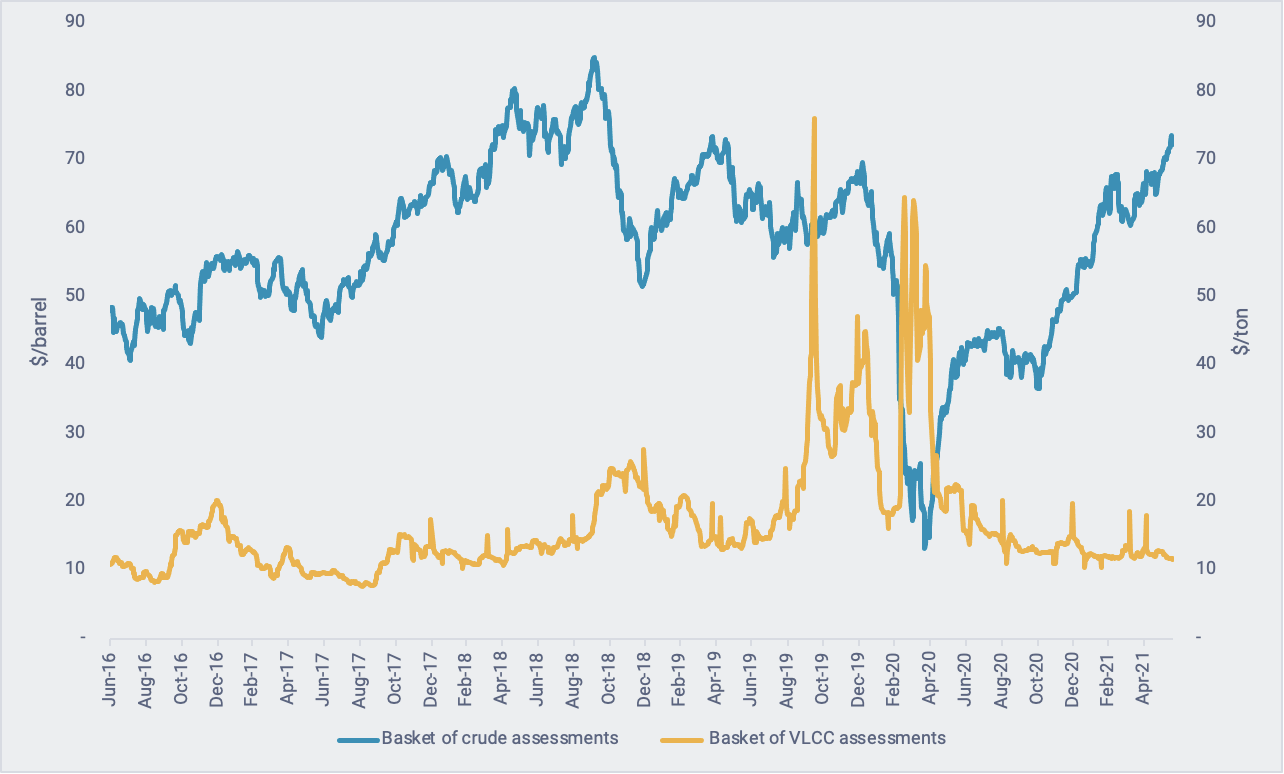

Correlation between the price of a barrel of crude and VLCC freight rates (Source: Argus Media)

- When assessing the relationship between the price of crude and freight rates we can see an inverse relationship from the onset on the above graph. Using a basket of crude assessments and a basket of VLCC freight rates (Argus Media), we obtain a negative correlation coefficient which tells us that in times of high crude prices, freight rates tend to decline.

- From a low of about $13/bbl in April 2020, our crude basket has since grown five-fold to today’s year-high of close to $74/barrel. In sharp contrast, our basket of freight rates has dropped more than 6-fold from a high of $65/mt in April 2020 to approximately $11/mt as of June 2021.

- Historical performance however cannot be relied on perfectly for future performance. But following a year of extraordinary events, we wonder whether this time the link between crude prices and freight rates can disconnect from historical norms.

- The recent rally in crude prices has been spurred by recovering oil demand, in turn increasing demand for the transportation of oil, which bodes well for tanker markets. All eyes remain fixated on the Middle East when it comes to crude supplies and thus crude cargo volumes on the market for freight.

Fixtures for VLCCs ex-MEG on the rise

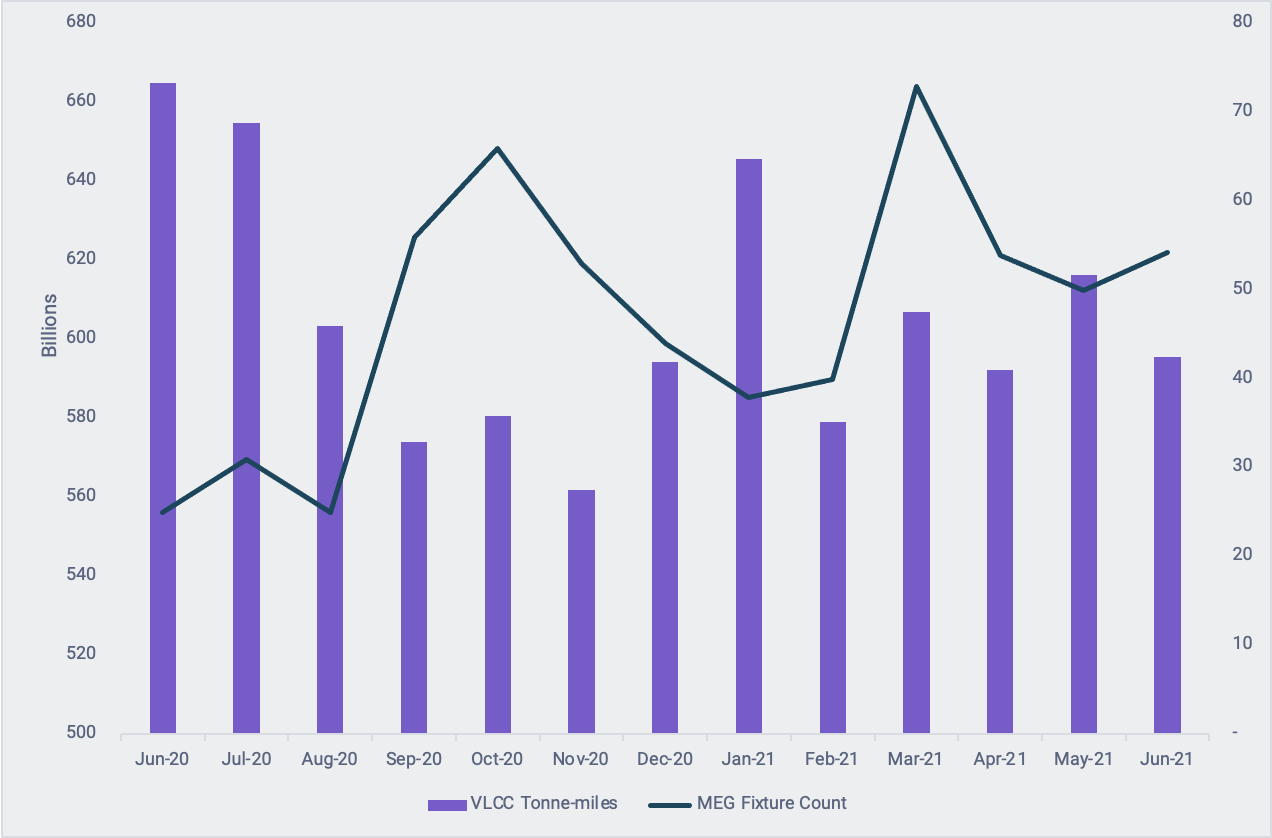

VLCC tonne-miles vs. MEG loading fixture count (See this data in our platform)

-

- When taking into account the number of VLCC fixtures recorded loading in the Middle East Gulf, bar a year-high in March 2021, June is witnessing the highest fixture count since October 2020. Whilst this seems to support a bullish trend in dirty tanker markets it could also simply be a consequence of increased output in July and thus a larger loading programme to work with, boosting the number of available cargoes and clearing out tonnage in the region.

- In a previous insight (click here to access) pertaining to the VLCC and Suezmax tanker segments we identified that tonne-miles for this combined fleet had remained relatively stable since the start of 2021. This however, hid different dynamics between tonne-days and average distance data with the former decreasing and the latter increasing, with an increase in longer-haul voyages from the Americas becoming apparent. If tanker utilisation were to increase on the MEG to East route, large crude tanker segments might experience a supply squeeze with tonnage already employed on longer-haul routes.

What happens next?

- A skyrocketing crude price might be contrary to the interest of some OPEC+ members and one way to mitigate that would be to increase output and volumes for export, thus increasing employment opportunities for crude tankers. This could have the potential to kickstart a much awaited freight rate rally in the dirty segment.

- It will however, stop short of benefiting owners involved in the CPP transport market. A rising price of crude feedstocks will fuel a rise in refined products prices throttling demand, potentially reducing margins and leading to lower refining activity. Furthermore, more crude available for export does not necessarily translate into more buying. Higher prices might lead to a curtailing of crude imports from countries such as China and dampen any crude tanker market recovery.

- Last but not least, with decarbonisation firmly on countries’ agendas, a rising price of crude will only help focus the attention of both the public and private sectors on energy alternatives, potentially dampening the long-term prospects of crude and refined products tanker markets.

Click here to register for a trial of Vortexa Freight Analytics

More from Vortexa Analysis

- Jun 22, 2021 Global jet fuel recovery running late, US emerging as bright spot

- Jun 18, 2021 Crude markets diverging in Atlantic Basin

- Jun 16, 2021 Question marks for freight rates in a largely supportive global LNG picture

- Jun 15, 2021 China’s independent refiners manoeuvre new diluted bitumen tax

- Jun 10, 2021 Planned storm still only a breeze in tanker markets