Q3 Freight Update: Momentum killed

As the world tries to shake off the pandemic, Vortexa looks at top-level tanker demand trends to understand how the Crude and CPP markets have fared compared to the pre-covid period, the previous quarter and what is in store for the future.

As the world tries to shake off the pandemic, Vortexa looks at top-level tanker demand trends to understand how the Crude and CPP markets have fared compared to the pre-covid period, the previous quarter and what is in store for the future.

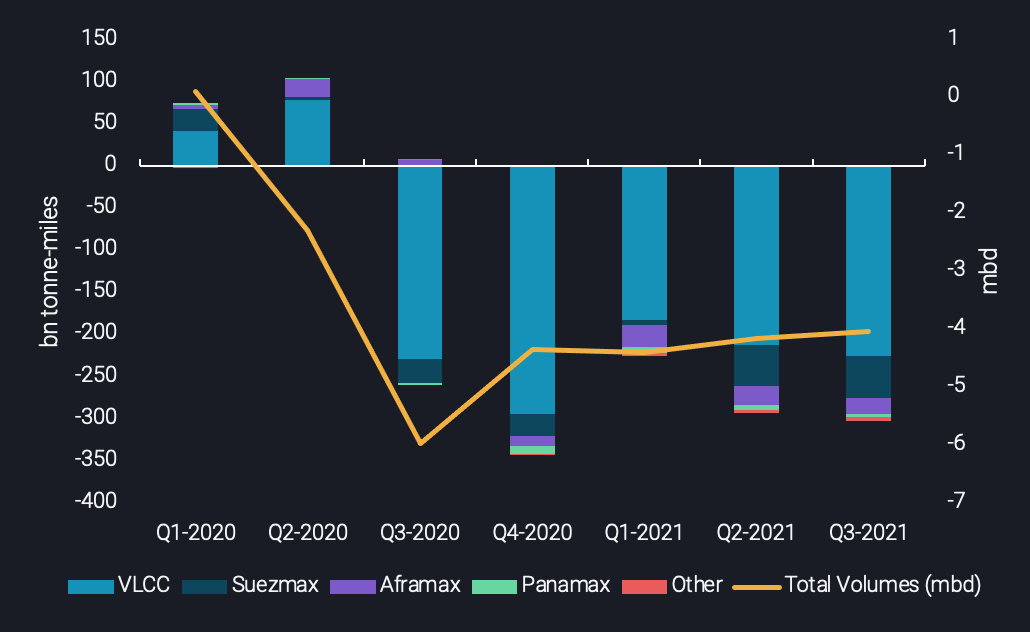

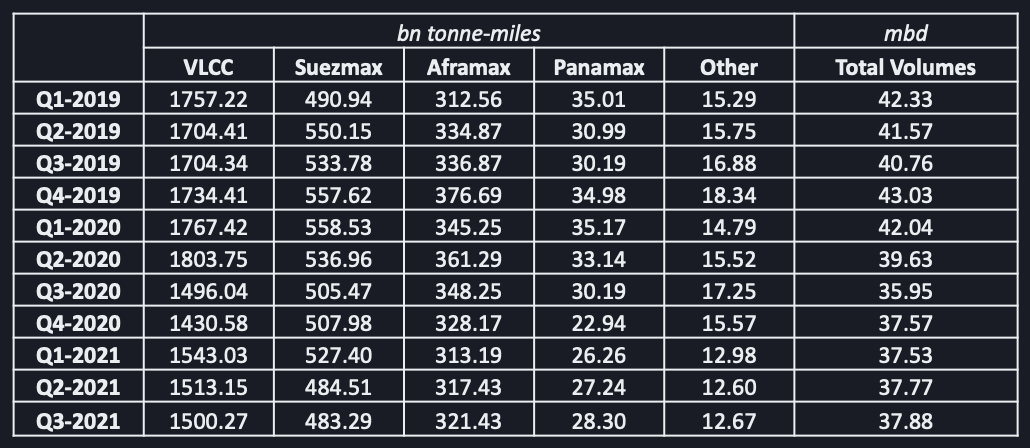

Crude: No light seen at the end of the tunnel for shipowners for now

- Looking at global seaborne crude exports, there has only been a slight increase in volumes from Q2 2021, remaining persistently at a 4mbd deficit to the 2019 average.

- Despite this uptick in exports, tonne-miles across crude tanker segments are trending downwards as the year progresses. This has mainly to do with the fact that a greater share of short-haul routes were performed in Q3 than in Q2.

- When focusing on the three main crude vessel classes, VLCCs bore the brunt of the subdued freight demand landscape, with tonne-miles in Q3 holding at 13% below 2019 levels.

- While the industry justifiably was focusing on the repercussions from China’s limited crude import quotas, there was evidence of OPEC+ members’ (except for Saudi Arabia and UAE) inability to ramp up supplies. West Africa’s production issues spearheaded an actual decline, which weighed especially on Suezmax employment over Q2 and Q3 2021, but also contributed to the decrease in VLCC tonne-miles.

Crude Tonne-miles and Global Crude Exports change from 2019 average

Crude Tonne-miles (billion tonne-miles) and Global Crude Exports (mbd)

- Looking ahead, the recent decision by OPEC+ to maintain previously agreed oil production increases, despite spreading supply concerns, will continue to buffer any crude tanker demand increase and hence challenge recently rising freight rates.

- Surging oil prices and the resulting wide Brent/Dubai EFS are incentivising Asian buyers to cut down their spot purchases from WAF and the Atlantic Basin, while raising exposure to Middle Eastern barrels in term deals. This will continue to weigh on dirty tonne-miles due to the relatively shorter distances travelled.

- European Aframaxes could provide a silver lining in the short run. Utilisation of Aframax tankers out of the Baltic and the Black Sea has marginally rebounded from annual lows, as Russia commences to ramp up its supplies. According to loading programmes, exports out of the Baltics are expected to increase, while maintenance on the CPC pipeline is over. Nevertheless, the impact to the overall tanker tonne-miles will be negligible.

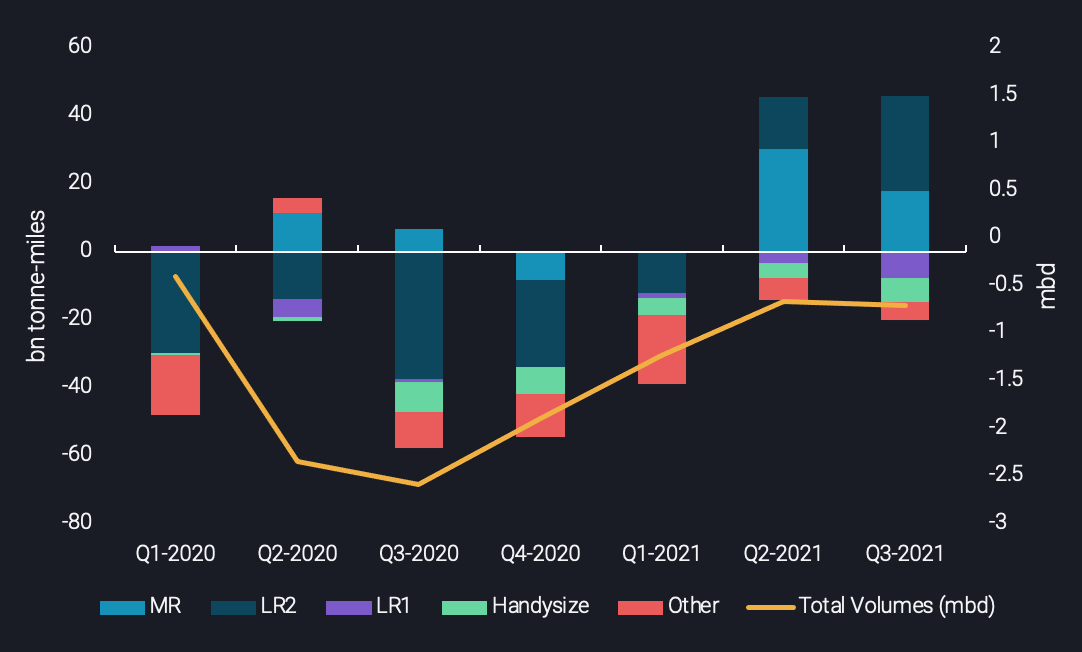

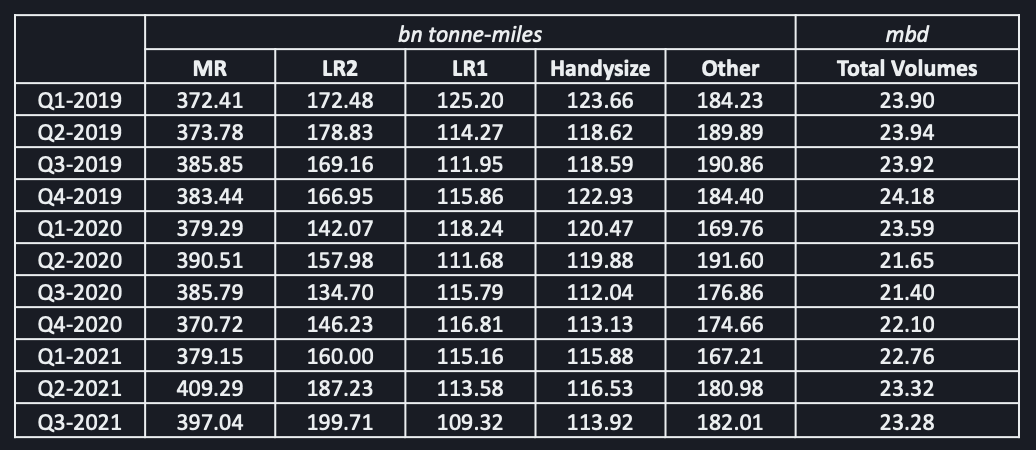

CPP: LR2s winning the competition

- Conversely to the crude segment, overall tonne-miles on clean cargoes have outpaced pre-Covid levels already in Q2 2021. However, the momentum stalled completely over Q3, with LR2 taking market share from the smaller segments.

- In fact, seaborne CPP exports have slightly fallen in Q3, and also remain below 2019 averages. Lower exports in combination with higher tonne-miles are explained by marginal refining assets having shut down, e.g. in Australia, while supplies were increasingly coming from core refining hubs, often far afield. Generally, the typical market imbalances (e.g. European gasoline length and diesel short, Asian naphtha short) have not been affected much by the pandemic.

- The only vessel class that managed to take the spotlight throughout Q3 is LR2 tankers. The multi-year highs seen on LPG prices during the summer made naphtha more attractive for steam crackers in Asia. Buyers sought naphtha cargoes mainly from the Middle East (where exports reached a 3-year high), but also Europe. This boosted LR2 utilisation to satisfy the persistently strong Asian petrochemical demand.

- On the flip side, the preference for LR2 tankers in long-haul routes had an inverse effect on smaller vessels. Tonne-miles for LR1 tankers realised a Q-o-Q drop, as freight rates for long-haul routes were at a premium to LR2s. Instead, LR1s found some solace on shorter-distance routes such as the Middle East to Europe.

- Focusing on MR tankers, we witnessed a similar effect to VLCCs. Even though cargo volumes carried on this size segment were stable Q-o-Q, tonne-miles declined as short-distance routes prevailed against the longer-haul ones. One key driver was the higher diesel demand seen in Latin America amidst the harvest season, which was mostly satisfied from cargoes out of the US Gulf. Similarly, subdued diesel consumption in India triggered higher volumes out of the country which found home in East Africa. On the negative side, weakening flows were realised for the longer transatlantic ARA – PADD 1 route amid refinery maintenance season in Europe, while the East Asia – Australia route is increasingly occupied by larger size segments at the expense of the MRs.

CPP Tonne-miles and Global CPP exports change from 2019 average

CPP Tonne-miles (billion tonne-miles) and Global CPP Exports (mbd)

- Looking forward, the healthy naphtha flows in the LR2 tanker trade are poised to continue. Throughout Q4 naphtha prices are traditionally in discount to LPG, and this winter the discount is set to blow out, as LPG fundamentals are boosted by the global power and natural gas shortage. Appealing naphtha prices, both on the buyer and refining side, are set to keep utilisation and tonne-miles of LR2s at high levels.

- For MRs, the situation is mixed as on the one hand employment is expected to increase but on the other this will predominantly occur in short-haul routes. Transatlantic volumes could see a support from lower-than usual diesel inventories in PADD 1 ahead of winter, which might trigger an increase of diesel flows from Europe to the US (reverse arb route). Nevertheless, the increasing refinery runs in PADD 3 post Hurricane Ida’s landfall could direct diesel towards PADD 1 via the Colonial Pipeline, competing with transatlantic flows.

- In Europe, the refinery maintenance season is approaching its end, while Russia is ramping up its supplies across the entire hydrocarbon chain. As a result, diesel demand will likely be satisfied to a stronger extent by intra-regional flows. This will act as a double-edged sword on the tanker market. The increase of intra-European volume will boost MR utilisation but will eventually replace Middle Eastern/Asia cargoes, which are traditionally carried on LR1 and LR2 tankers, ultimately easing overall tanker demand.

More from Vortexa Analysis

- Oct 06, 2021 Flow highlights: Intriguing trends in crude & fuel oil, while light-end strength continues

- Oct 05, 2021 Puzzling trends in North Sea crude

- Sep 30, 2021 Europe’s flexible gas markets backfire in global energy crunch

- Sep 29, 2021 OPEC+ supply trends and their repercussions on Asian buyers

- Sep 28, 2021 Reality check: Middle East saves global crude market from massive shortfall

- Sep 23, 2021 Shipping is navigating through uncharted and uncertain territories

- Sep 23, 2021 Looking for lasting repercussions of US storms

- Sep 20, 2021 Flow highlights: Tight supply continues to support prices across the board

- Sep 16, 2021 LatAm road fuel imports set for decline after hitting record

- Sep 15, 2021 Can Asian gasoline sustain their strength in Q4 2021?

- Sep 15, 2021 Reality check: is China ready for U-turn after weakness in last months?