Global refining industry struggles to stem growing market tightness

The global refining industry is facing immense challenges in ramping up runs. With Asia and Europe’s refiners entering maintenance season, and current product inventories near historical lows, the market could see more tightness looming ahead.

Global refined product prices are racing ahead of crude prices, as the refining industry struggles to keep pace with growing oil demand. Across the world’s major oil storage hubs, inventories have drawn from the highs seen at the peak of the pandemic just two years ago to near historical lows today. More concerningly, Asia and Europe will be entering their refinery maintenance season next quarter with limited indications that refiners are ramping up runs to build inventories ahead of their turnarounds – which means more tightness could be looming ahead.

Refiners face uphill battle in ramping up runs

While strengthening product cracks are supportive of stronger refinery runs, it only forms part of the equation. Behind the scenes, high natural gas prices and rising carbon tax costs (in Europe) are swelling refiners’ operational costs and offsetting the stronger cracks. With crude prices soaring, financing crude purchases have also become a challenge for financially weaker refiners, a case in point being Vietnam’s Nghi Son refinery that was on the brink of a shutdown last month. Somewhat related, the massive backwardation is complicating the life of refiners. While current crude procurement, especially for the sweeter grades, has to be done at the crest of spot diffs and market structure, the derived product supply has to be marketed and accounted for further down the curve. Diesel cracks in Europe for example don’t look that healthy from this perspective.

New refining capacities only coming online in H2 2022

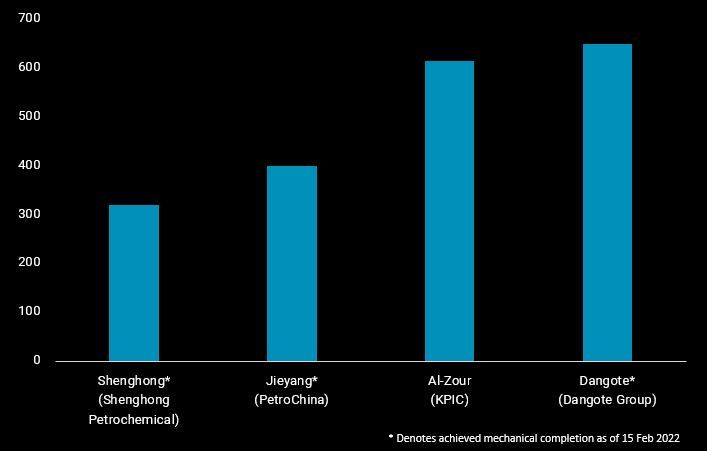

The net loss in global refining capacity last year of around 730kbd (as per IEA) has dashed hopes of an alleviation of the supply tightness in the near-term. New refining capacity to come online this year amounts to nearly 2mbd, but is likely to become available only in the second half of the year. This includes Kuwait’s Al-Zour refinery, China’s Jieyang and Shenghong refineries as well as Nigeria’s Dangote refinery, with possible delays in the start-ups pushing commercial operations of some refineries out to next year.

Global new refineries starting in 2022

Asia and US long-haul trades falter with growing regional tightness

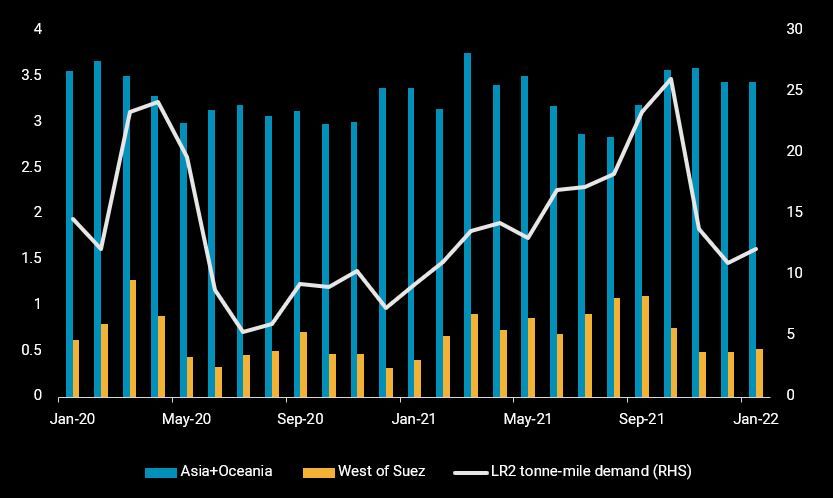

As regional balances tighten, long-haul trades from Asia and the US have slowed significantly in recent months. Close to 500kbd of clean products were loaded from Asia to the West of Suez (WoS) in the last three months, almost half the volumes seen at the peak in Q3 2021. Instead, clean barrels were traded within the region, including Australia, which saw a near 20% uptick in import volumes in the same period. The lack of long-haul trades from Asia has dealt a direct blow on LR2 tonne-mile demand for clean products, which tumbled by 15% in January vs Q3 2021, contributing to the overall weakness in LR2 rates in the Pacific Basin.

Asia’s clean product exports to selected destinations (LHS, Mbd) and LR2 tonne-mile demand for clean products from Asia (RHS, bn tonne-mile)

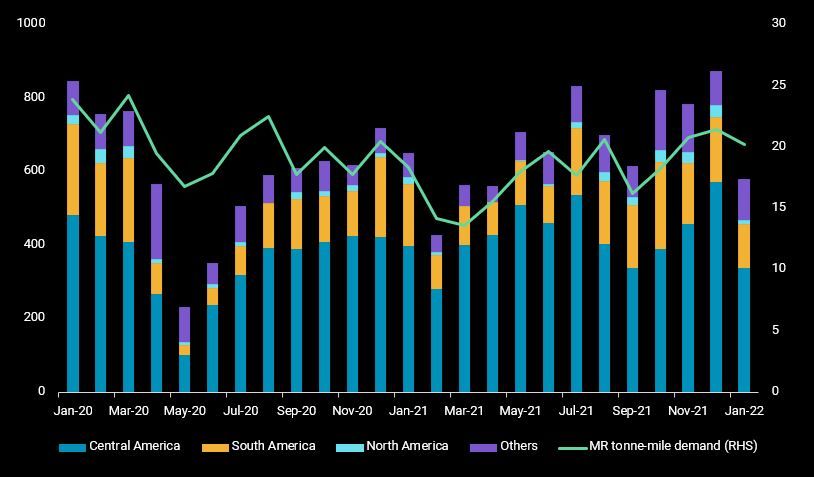

In the US, tight gasoline supplies due to the strong refinery and fluid catalytic cracker (FCC) maintenance this quarter has led to the country’s gasoline exports sinking to a 7-month low in January, with volumes trending down further in the first two weeks of this month. Fortunately, the fall of tonne-miles for gasoline from the US has been partially offset by stronger tonne-mile demand for jet and diesel, cushioning the impact on the overall TC18 MR tanker rates.

US gasoline exports by destination region (LHS, kbd) and MR tonne-mile demand for clean products from the US (RHS, bn tonne-mile)

Demand potential at crossroads with spare refining capacity and inflation pressures

Rising inflation is increasingly dampening consumer sentiments and could be one of the wild cards that slows or derails the current trajectory of growing tightness globally. But towards the end of a 2-year pandemic, even strongly rising flight ticket or tank fill costs may not be deterring consumers from travelling. Currently hopeful Covid perspectives could make up for a strong demand cocktail together with the seasonal upside from the Northern hemisphere spring season. Against this backdrop, global refiners may well struggle to catch-up with demand, and the window to do this before the start of Asia and Europe’s refinery maintenance season next quarter is getting smaller.

Spare capacity is not only an issue for OPEC+ crude production but also for the world refining system. Japan, one of the few places with viable unused capacity has already hiked runs by almost 40% over the last two months compared to last June, leading to a well-needed spike in clean product supplies to the regional market. Otherwise, there are basically two types of spare capacity. On the one hand, installed capacity that has not been used for many years, as for example 50% of Mexico’s capacity, and on the other Chinese capacity that is withheld by Chinese policy makers. To drag some of those capacities back into the market, refining margins may well need to rise faster and higher to give refiners or policy makers a stimulus to ramp up runs, and crude suppliers an even stronger incentive to make the necessary barrels available.

More from Vortexa Analysis

- Feb 10, 2022 Global sweet crude exports edge higher in January

- Feb 9, 2022 How much further will global crude inventories fall?

- Feb 8, 2022 How is Omicron impacting Asia’s oil demand so far?

- Feb 2, 2022 Can clean tanker markets benefit from surging diesel prices?

- Feb 1, 2022 Russian roulette being played out in Ukraine, leaving the gas market guessing

- Jan 27, 2022 Naphtha & LPG: Falling freight rates suggest flows will remain curtailed

- Jan 26, 2022 Reality check on Russian oil and gas sanctions

- Jan 25, 2022 China’s crude destocking pauses. Is it looking for a refill?

- Jan 20, 2022: Maiden Crude Tanker CPP Voyages: What happened and what to expect

- Jan 19, 2022: Oil price rally is driven by lack of supply right now

- Jan 18, 2022: Global diesel market pricing in tighter supplies ahead

- Jan 13, 2022: Omicron: pre-emptive supply cuts & resilient demand draw stocks and lift prices